Personal Finance Basics set the stage for financial stability and peace of mind, guiding beginners with clear, practical steps instead of buzzwords. Starting with budgeting basics helps you see where every dollar goes and builds confidence to set achievable goals. From there, you establish small, automatic habits—save a portion of income, review spending, and adjust as life changes. This approach is designed for those who want clarity over buzzwords and a practical plan to transition from earning a paycheck to building a secure future. By starting with these fundamentals, you’ll create a flexible framework that supports short-term stability and long-term growth.

Think of financial well-being as a practical blueprint for daily decisions, where income, spending, and saving form a balanced system. This starter guide uses plain language to map out money management ideas, from tracking cash flow to setting achievable targets. By framing the topic with terms like building a financial base, protecting against surprises, and choosing simple, low-cost options, you gain confidence without getting bogged down in jargon. These concepts support the same goals—clarity, consistency, and resilience—while expanding the vocabulary readers use to describe their finances.

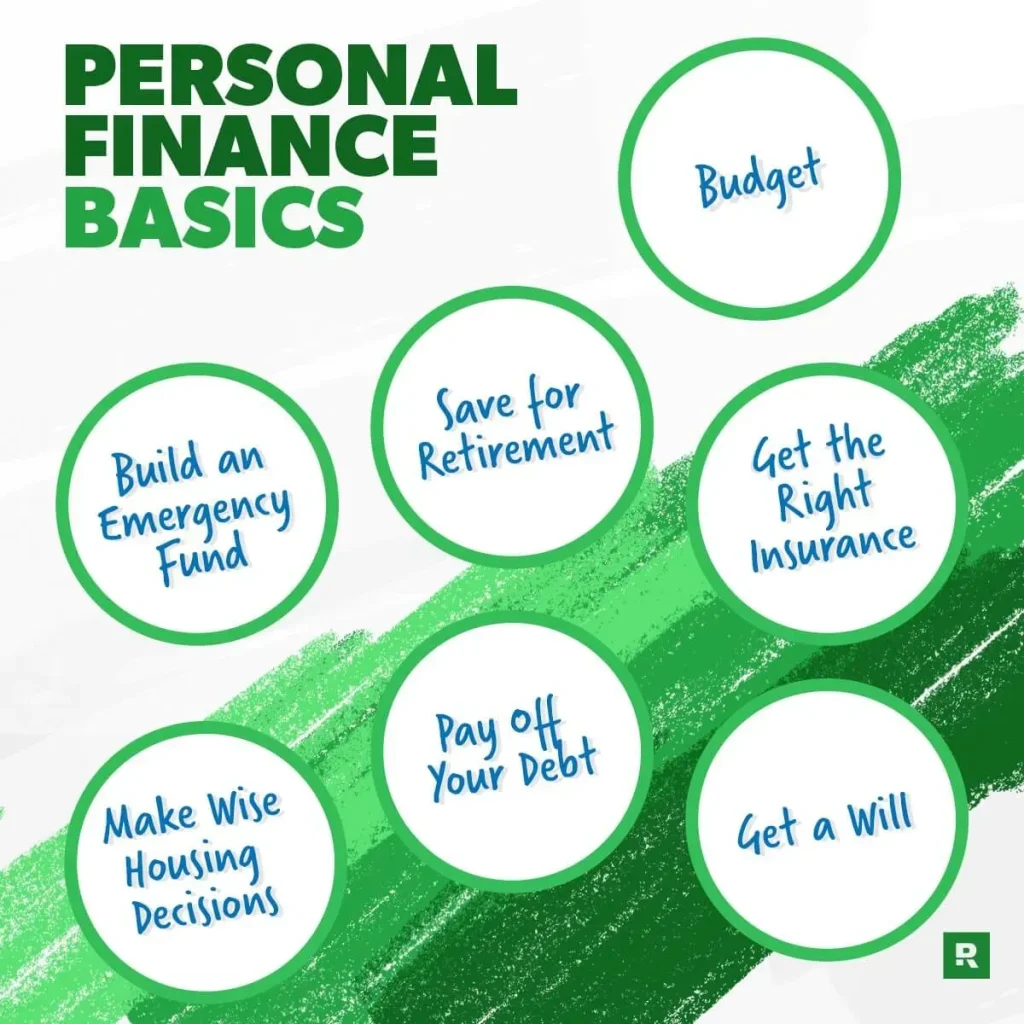

Personal Finance Basics: Building a Financial Foundation for Beginners

Building a solid financial foundation starts with budgeting basics and practical saving strategies. For those exploring personal finance for beginners, taking control of where money goes is the first step toward lasting stability. The 50/30/20 rule provides a simple framework: 50% of take-home pay to needs, 30% to wants, and 20% to savings and debt repayment, offering clarity without feeling deprived.

A practical path combines consistent tracking with automation: use a straightforward budgeting tool or app, or even a notebook, to monitor spending, and set up automatic transfers to savings. By prioritizing an emergency fund, debt payoff, and short- to medium-term goals, you build a resilient financial foundation that supports future investing and smarter money decisions.

Emergency Fund Importance and Debt Management: Stabilizing Your Long-Term Finances

Emergency fund importance is central to Personal Finance Basics. A dedicated reserve equal to three to six months of essential expenses creates a safety net against job changes, medical costs, or unexpected repairs, helping you avoid high-interest debt during tough times.

With a funded emergency fund, focus on debt management strategies such as the debt snowball or avalanche to reduce balances and lower interest costs. As you chip away at debt, reallocate freed cash toward saving strategies and building your financial foundation, reinforcing budgeting basics and setting you up for longer-term goals like homeownership or retirement.

Frequently Asked Questions

What are the essential steps in Personal Finance Basics for beginners to start building a financial foundation?

In Personal Finance Basics for beginners, start by tracking your spending for 1–2 months to see where money goes. Apply budgeting basics such as the 50/30/20 rule to allocate needs, wants, and savings. Set up automatic transfers to a savings account as part of saving strategies, and begin building an emergency fund to cover three to six months of essential expenses. Recognize the emergency fund importance and outline a debt-management plan to reduce high‑interest debt, strengthening your overall financial foundation.

How does the emergency fund importance fit into Personal Finance Basics and building a financial foundation?

Emergency fund importance is central to resilience in Personal Finance Basics. It buffers you from job loss or unexpected costs and keeps your long‑term goals on track. Aim for three to six months of essential expenses, automate contributions, and keep the fund separate from everyday spending. As life changes, revisit your target and continue using budgeting basics and saving strategies to grow and protect this cornerstone of your financial foundation.

| Section | Key Points | Practical Tips |

|---|---|---|

| Budgeting basics | Track every dollar for 1–2 months; identify fixed costs (rent, utilities, debt) and variable expenses (groceries, transport, dining); apply the 50/30/20 rule: 50% needs, 30% wants, and 20% to savings and debt payments; goal is clarity and steady progress. | Record expenses weekly; use a budgeting tool or notebook; make small adjustments (cook at home, cancel unused subscriptions, renegotiate bills); review plan monthly. |

| Saving strategies | Savings form the backbone of resilience: automate transfers right after payday; treat savings like a bill; split your income at the source when possible; set concrete, time-bound goals (emergency fund, down payment, education). | Set up direct deposits or automatic transfers; use high-yield savings for near-term needs; utilize tax-advantaged accounts for longer horizons; diversify savings over time as you grow more comfortable. |

| Debt management | List debts with interest rates, minimum payments, and balances; choose a payoff method (debt snowball or debt avalanche); stay motivated and consistent. | Create a targeted payoff plan; trim discretionary spending; negotiate lower interest where possible; maintain an emergency fund to avoid new debt when surprises arise. |

| Building a financial foundation | Track net worth (assets minus liabilities); monitor liquidity and protection; emergency fund is a cornerstone; consider basic protections like health, auto, home, life, and disability insurance. | Regularly update net worth; ensure adequate insurance; keep liquidity accessible yet separate from daily spending. |

| Emergency fund importance | Aim for three to six months of essential living expenses in a separate, accessible account; start with one month if daunting and increase over time. | Automate small weekly contributions; keep the fund separate from everyday spending; adjust target as life changes (new job, family, mortgage). |

| Investing and long-term planning (intro) | Introduce investing after short- to mid-term stability; start with an employer plan or IRA; choose low-cost, diversified options such as index funds; aim for a simple, passive approach that compounds over time. | Begin with small contributions; align with risk tolerance and time horizon; reassess periodically and adjust as goals evolve. |

| Practical steps and a simple plan | 90-day action plan: track spending for 30 days; create a realistic budget; build or top up emergency fund to cover at least three months; pay down high-interest debt using snowball or avalanche; set up automatic transfers to savings and retirement accounts. | Follow the 90-day plan, review progress weekly, adjust as needed, and celebrate milestones. |

Summary

Personal Finance Basics lays the groundwork for smarter money decisions and lasting security. This descriptive overview outlines budgeting, saving, debt management, emergency funds, and introductory investing, providing practical steps that beginners can apply today to build a more stable financial future. By emphasizing clarity, consistency, and a plan you can actually follow, Personal Finance Basics guides you from earning a paycheck toward long-term wealth and resilience.