Finance vs Budgeting sets the foundation for how we think about money across time and goals. While many people mix them up, the distinction matters for choosing the right actions and avoiding wasted resources. Finance vs Budgeting explains how strategic capital decisions align with day-to-day spending, guiding both personal and business outcomes. This guide highlights the difference, why it matters, and how you can apply practical practices to balance long-term growth with short-term control. By weaving together concepts such as finance vs budgeting difference, budgeting vs financial planning, personal budgeting tips, financial management vs budgeting, and how budgeting impacts finances, you’ll build a clearer path to financial health.

Think of this relationship in alternative terms: strategic money management paired with disciplined spending. Capital planning guides investments, risk, and liquidity, while a defined spending plan translates those intents into monthly actions. A budget serves as a cash-flow map that aligns near-term choices with longer-term goals, keeping priorities visible and achievable. When you expand the language to include terms like revenue planning, liquidity management, cost control, and expense forecasting, you apply LSI principles to connect broad concepts with concrete steps.

Finance vs Budgeting: Clarifying the Difference and Its Practical Impact

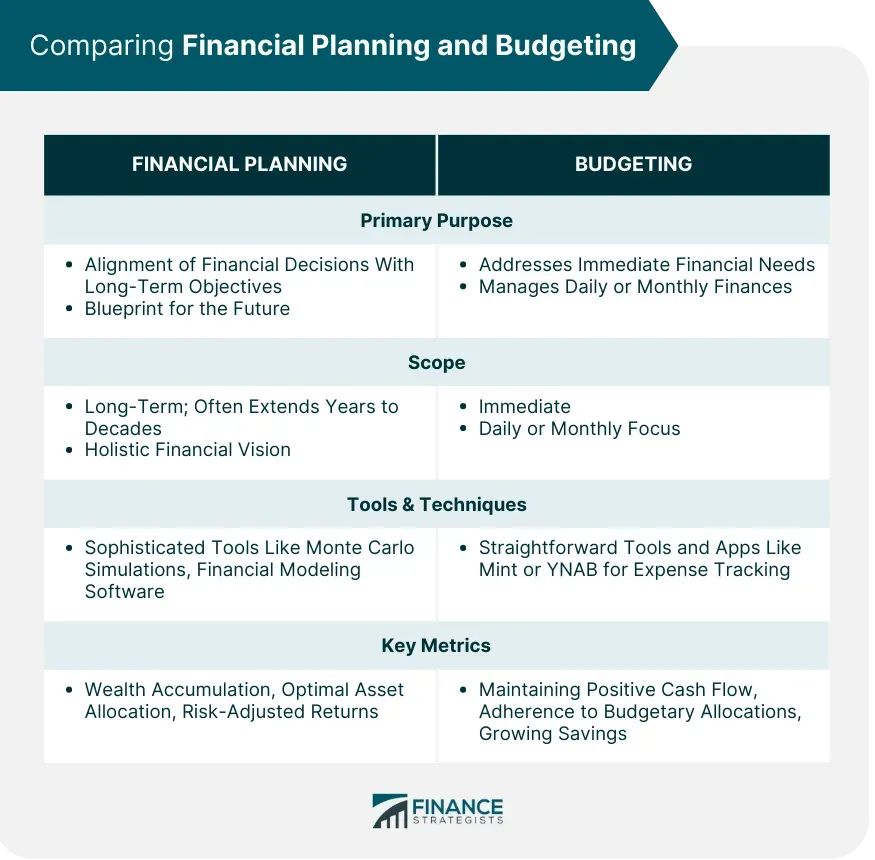

Finance vs Budgeting difference is not just semantic; it shapes what you measure and how you act. Finance asks big questions about capital allocation, risk, and long horizons, while budgeting translates those choices into concrete monthly and yearly cash flows. Recognizing this separation helps you avoid misaligned plans, wasted resources, and frustrated goals as you manage money in both personal and business contexts.

By connecting finance with budgeting, you can define a clear path from strategy to action. This is where budgeting vs financial planning comes into play: finance sets the direction and risk framework, while budgeting grounds those ideas in numbers you can actually spend, save, and invest. When you understand how budgeting impacts finances, you can forecast more accurately and adjust as conditions change.

Budgeting, Financial Planning, and Personal Budgeting Tips: Building Resilience Across Personal and Business Finances

Budgeting acts as the practical engine that turns financial strategy into day-to-day choices. Seeing financial management vs budgeting as a continuum helps you build liquidity, protect against shocks, and pursue growth with discipline. When you look at the bigger picture, budgeting is the operational channel through which long-term value is created.

For personal budgeting tips, start with simple, scalable methods like the 50/30/20 rule or zero-based budgeting for larger goals. Track income and expenses, automate savings, and regularly reforecast your plan to reflect life changes. These steps illustrate how budgeting impacts finances by strengthening cash flow, reducing debt, and supporting meaningful investments in retirement, education, or business expansion.

Frequently Asked Questions

What is the finance vs budgeting difference, and why does it matter for personal and business planning?

The finance vs budgeting difference lies in scope and purpose: finance covers long-term strategy, capital allocation, and risk, while budgeting translates that strategy into concrete near-term spending and saving plans. Recognizing this distinction helps you avoid chasing short-term savings at the expense of long-term goals, and ensures daily decisions align with bigger aims. When you combine solid financial planning with disciplined budgeting, you improve liquidity, resilience, and the ability to fund growth.

How does budgeting impact finances and how does budgeting relate to financial planning (budgeting vs financial planning)?

Budgeting impacts finances by turning goals into monthly cash flows and category allocations (housing, debt, savings). The budgeting vs financial planning distinction shows budgeting focuses on current resources and near-term actions, while financial planning addresses long-term goals, risk management, and capital needs. To apply them, map income and costs, set priorities, and regularly review variances so your budget supports your financial plan and preserves liquidity. This approach also demonstrates how budgeting impacts finances and can be reinforced with personal budgeting tips to automate savings and priorities.

| Area | Key Point | Notes |

|---|---|---|

| Introduction | Finance vs Budgeting are related but distinct concepts. | Understanding their interaction strengthens financial planning for personal and business contexts. |

| What is Finance? | Broad discipline for managing money over time. | Covers capital allocation, risk, funding, investments, and long-term planning; differences exist between personal and business contexts. |

| What is Budgeting? | Practical process for planning income and spending over a defined period. | Translates goals into numbers, allocates categories, and guides day-to-day decisions; a tool within finance. |

| The Finance vs Budgeting Difference: Key Concepts | Finance focuses on capital, risk, and long horizons; Budgeting focuses on current resources and near-term actions. | Finance informs strategy; budgeting implements it as a spending plan; together they shape decisions and outcomes. |

| Why This Distinction Matters | Real-world reasons to treat them as connected but distinct. | Personal finances, business finances, and long-term resilience benefit from alignment. |

| How to Align Finance and Budgeting in Practice | Seven practical steps to align them. | 1) Define goals; 2) Map income/costs; 3) Build a budget aligned with strategy; 4) Integrate risk management; 5) Plan debt and liquidity; 6) Monitor and adjust; 7) Use right tools and metrics. |

| Common Pitfalls to Avoid | Common mistakes that derail alignment. | Short-term focus; overly aggressive budgets; treating budgeting as one-time; ignoring link to broader finance; failing to adjust to changes. |

| Real-World Scenarios | Illustrative examples in personal and business contexts. | Personal budgeting tips; Small business expansion; Budgeting in financial management discussions. |

| Practical Takeaways and Actionable Tips | Concrete actions to apply the concepts. | Start with budgeting’s impact on finances; use frameworks like 50/30/20; translate budgeting into cash-flow models; link budgeting with performance; keep learning. |

Summary

Finance vs Budgeting is a foundational distinction that shapes how individuals and organizations plan, allocate resources, and manage risk over time. Finance provides the strategic framework for capital allocation, risk management, and long-term value creation, while budgeting translates that strategy into monthly or yearly plans and day-to-day decisions. Understanding how these two activities interact helps reduce waste, improve resilience, and align operations with goals across personal and business contexts. By learning where finance ends and budgeting begins, you can optimize cash flow, protect against disruptions, and pursue growth with discipline. In practice, aligning budgeting with a broader financial plan supports consistent decision-making, better performance measurement, and a clearer path to long-term objectives.