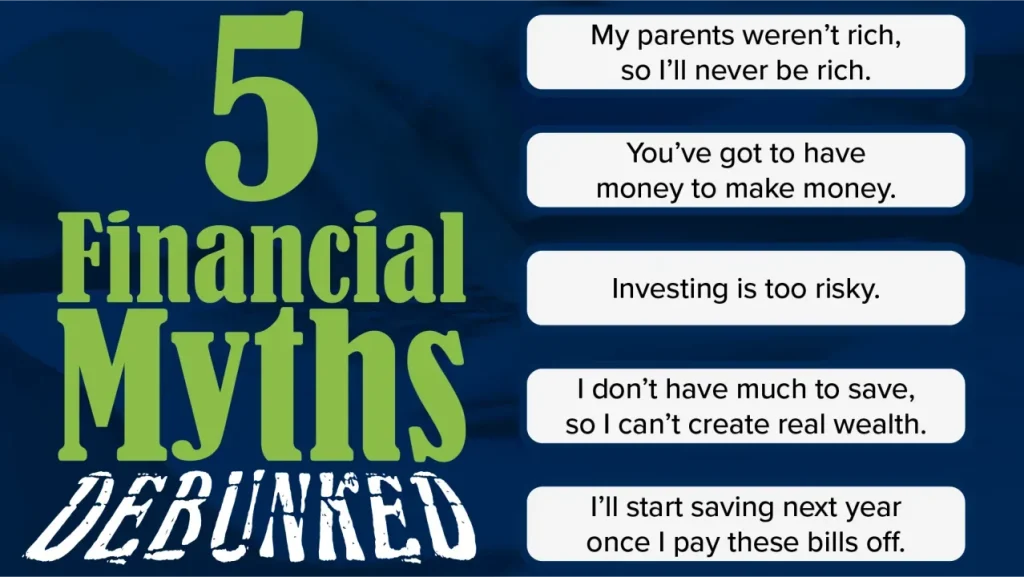

Finance Myths Debunked is more than a catchy headline; it serves as a practical guide to separating money myths from realities and clarifying money myths vs facts. In a world full of tips, tricks, and overnight success stories, many people cling to financial literacy myths that hinder progress. This article presents a clear, evidence-based view on common money myths, backed by practical steps you can take today. By comparing widely held beliefs with real-world numbers, you’ll discover facts about money management that support smarter, calmer decisions. Ultimately, embracing a debunking finance myths mindset can empower you to take control of your financial future.

From a reader’s perspective, these misconceptions about money fade when you replace myths with tested principles and trackable results. This shift reframes the topic into money intelligence, budgeting discipline, and prudent borrowing rather than guesswork. As you adopt these ideas, you’ll see how common money myths can distort choices about saving, investing, and debt. By grounding guidance in practical numbers and real-world scenarios, you move toward accurate facts about money management and more confident financial decisions.

Finance Myths Debunked: From Common Money Myths to Practical Financial Literacy

Finance Myths Debunked frames money myths vs facts as a practical starting point for smarter choices. Rather than chasing overnight windfalls, you can build steady progress by recognizing that wealth is not a prerequisite for good money management. By separating myths from reality, you empower yourself to take cautious, data‑driven steps that align with long‑term financial literacy goals.

Exploring money myths vs facts and the related idea of financial literacy myths helps reduce anxiety around money. This perspective emphasizes that budgeting, saving, and investing are accessible to most people, and that reliable facts about money management should guide decisions instead of hype or fear.

Practical steps to debunk finance myths include starting small with investing, using low‑cost index funds, and setting up automatic contributions. It also clarifies that debt can be a useful tool when paired with a clear repayment plan, moving away from blanket ‘all debt is bad’ narratives common in financial literacy myths.

Turning Knowledge into Action: Practical Steps Aligned with Facts About Money Management

Turning knowledge into action begins with daily habits. Start by tracking every expense for 30 days to reveal true spending patterns, and use a simple budgeting framework like 50/30/20 or a tailored version to suit your income. This makes budgeting feel like a practical tool rather than a restriction, addressing common money myths with concrete data.

Next, build an emergency fund, automate contributions to retirement or investment accounts, and choose low‑cost, diversified options such as index funds. These steps reflect facts about money management by emphasizing liquidity, consistency, and cost awareness, which are essential to turning knowledge into sustainable results.

Finally, approach debt with intention: compare interest rates, create a realistic payoff timeline, and recognize that some debt—like a mortgage or student loan—can support future earnings. This aligns with debunking finance myths by showing that debt can be purposeful when paired with clear goals.

Frequently Asked Questions

What is Finance Myths Debunked, and how can it help me differentiate money myths vs facts to improve my financial literacy?

Finance Myths Debunked is a practical guide to separating money myths from facts and boosting your financial literacy. It contrasts money myths vs facts and offers actionable steps – like starting investing with small amounts, following a simple budget, and using debt responsibly. By grounding guidance in real-world numbers, it helps you make smarter decisions and reduce money-related anxiety.

Which common money myths does Finance Myths Debunked address, and what practical steps can I take today to apply the facts about money management?

Finance Myths Debunked highlights common money myths and translates the facts about money management into concrete actions you can take today. It explains why budgeting can increase freedom, how to use debt strategically, and how to adopt a long-term investing mindset. With clear tips rooted in financial literacy myths, you can start implementing change now and build lasting financial progress.

| Theme | Key Points | Practical Takeaways |

|---|---|---|

| Purpose and framing of Finance Myths Debunked | A practical guide to separating money myths from realities; evidence-based view on common beliefs; backed by real-world numbers; aims to improve financial literacy and reduce money anxiety. | Adopt a myth-vs-fact mindset and apply practical steps today; rely on data to guide decisions. |

| Myth 1: You must be rich to start investing | Investing is accessible even with small savings; start small with low-cost index funds; automatic contributions; investing is a long-term, consistent endeavor, not a quick windfall. | Begin with a modest amount, automate contributions, choose low-cost index funds, and view investing as a long-term habit. |

| Myth 2: Budgeting is restrictive and unnecessary | Budgeting is a tool that enables financial freedom; it directs money to priorities, reduces waste, and supports emergencies and goals; commonly cited 50/30/20 rule as a simple framework. | Use budgeting as a flexible plan that evolves with income and expenses; implement a simple framework and adjust as needed. |

| Myth 3: Credit scores are only important when you want a loan | A good credit score influences insurance premiums, housing applications, and some job opportunities; it reflects debt management, repayments, and utilization. | Pay on time, keep balances low relative to limits, avoid unnecessary new debt to maintain a healthy score. |

| Myth 4: All debt is bad debt | Distinguish good debt (education, mortgage) from high-cost debt; strategic borrowing can support goals when paired with a plan and realistic budget. | Evaluate debt by cost, purpose, and potential asset/return; use debt strategically with a clear repayment plan. |

| Myth 5: Investing is only for experts | Basic investing concepts are accessible; start with diversified index funds; learn gradually; education is a powerful equalizer. | Build knowledge in small steps, focus on core principles (diversification, risk tolerance, costs) and expand over time. |

| Practical steps to debunk common money myths | Concrete actions to counter myths: track expenses for 30 days; build an emergency fund; automate retirement/investment contributions; learn debt basics; read trusted financial resources. | Follow these steps to establish discipline and measure progress; use automation and ongoing learning to reinforce facts over hype. |

| Common mistakes when confronting finance myths | Misbeliefs include equating high income with wealth, treating a budget as static, underestimating compounding, ignoring fees/taxes, and avoiding debt entirely without evaluating purpose. | Accept flexible budgeting, account for costs, monitor compounding, and assess debt’s role to avoid these errors. |

| Broader perspective on money myths vs facts | Translating information into action; building discipline around saving, investing, and spending to support long-term goals; replacing myths with practical knowledge. | Move from information to repeatable practices; start where you are and progress with small, consistent steps. |